Most of the leading cryptocurrencies remained flat at the end of the previous trading week. The second-largest cryptocurrency, Ethereum, is now down by 6.4%. In the last seven days, Bitcoin plummeted by 1.3%. This happens even though the markets are still being impacted by the FTX catastrophe, which was caused by the collapse of the Sam Bankman-Fried (SBF) cryptocurrency business, which occurred two weeks ago.

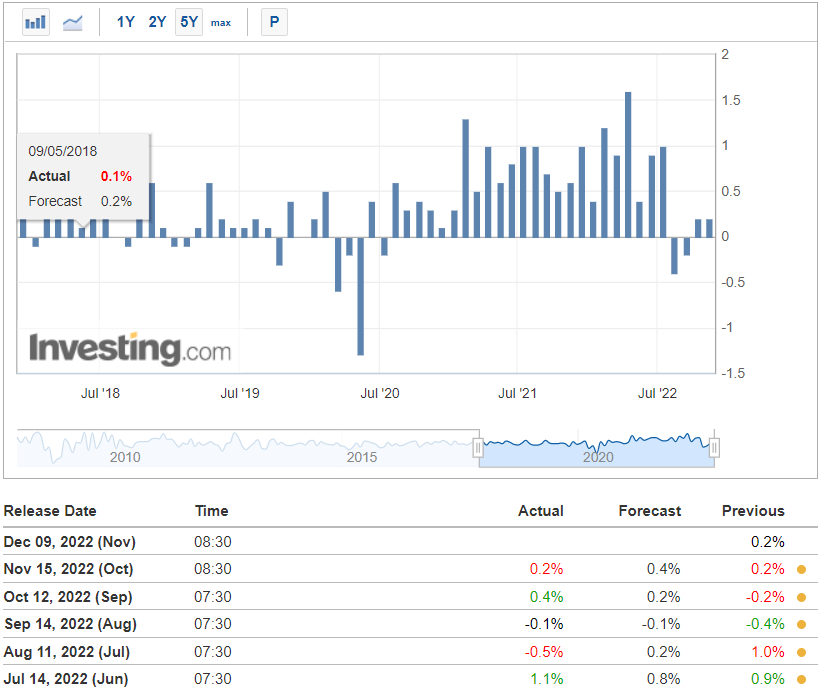

The latest PPI (Producer Price Index) report from the U.S. Labor Department, which came in at 0.2% month-over-month vs estimates of 0.4%, gave the cryptocurrency market some hope last Tuesday, November 15. It’s conceivable to see this as an indication that U.S. inflation may begin slowing down, allowing the Federal Reserve to loosen its strict financial policies. As a result, high-risk assets like cryptocurrency and equities may flourish.

Among the leading cryptocurrencies, Solana suffered the most losses (SOL). The whole Solana ecosystem was impacted by the event since FTX was one of Solana’s earliest supporters and one of its largest investors. In the previous seven days, the price of SOL has dropped 15%.

Bitcoin (BTC)- Since the market collapse last week, as was previously highlighted, the price of the cryptocurrency with the largest market cap has remained the same. Many investors are sensitive and impulsive, and the Fear and Greed Index has shown Extreme Fear over the last week.

Bitcoin is now trading around the $16,700 mark, and if the bullish trend holds this week, the next resistance level to observe is approximately $20,000. The next support of Bitcoin will be around $11,800, but if the FTX scandal’s unfavourable perception spreads panic throughout the market, it may continue to do so.

Ethereum (ETH)- Over the previous week, Ethereum has been slightly weaker than Bitcoin, with the cryptocurrency falling by over 7%. Given that it is a solid support area and a statistic that has a huge psychological impact on traders, the $1,000 threshold is important for Ethereum.

The second-largest cryptocurrency by market cap is now trading at around $1,200. The next resistance level, lying around $1,400, will be reached if the present bullish momentum is prolonged. The next major support level might be situated around $500 if sellers take back control.

After trading FTX-drained currency for Ether for consecutive days, the so-called “FTX Accounts Drainer” is now trading its Ether stack for Bitcoin, which is driving down the price of Ether. According to blockchain tracker PeckShieldAlert, the exploiter swapped around 5,000 ether for 347 renBTC – a sort of wrapped Bitcoin on Ethereum that can be redeemed for native Bitcoin. The price of Ether is under pressure as a result of the so-called “Drainer” now swapping its stack for Bitcoin. Approximately 45,000 Ether had been sold.

Are you ready to dive into crypto?

Join us for more updates: Facebook | Telegram | Linkedin | Twitter

MX Global– Built in Malaysia for Malaysians

Legal Risk Disclosure:

Trading on cryptocurrency carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade with MX Global, you should carefully consider your investment objectives, level of experience, and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with cryptocurrency trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices, or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

MX Global Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.